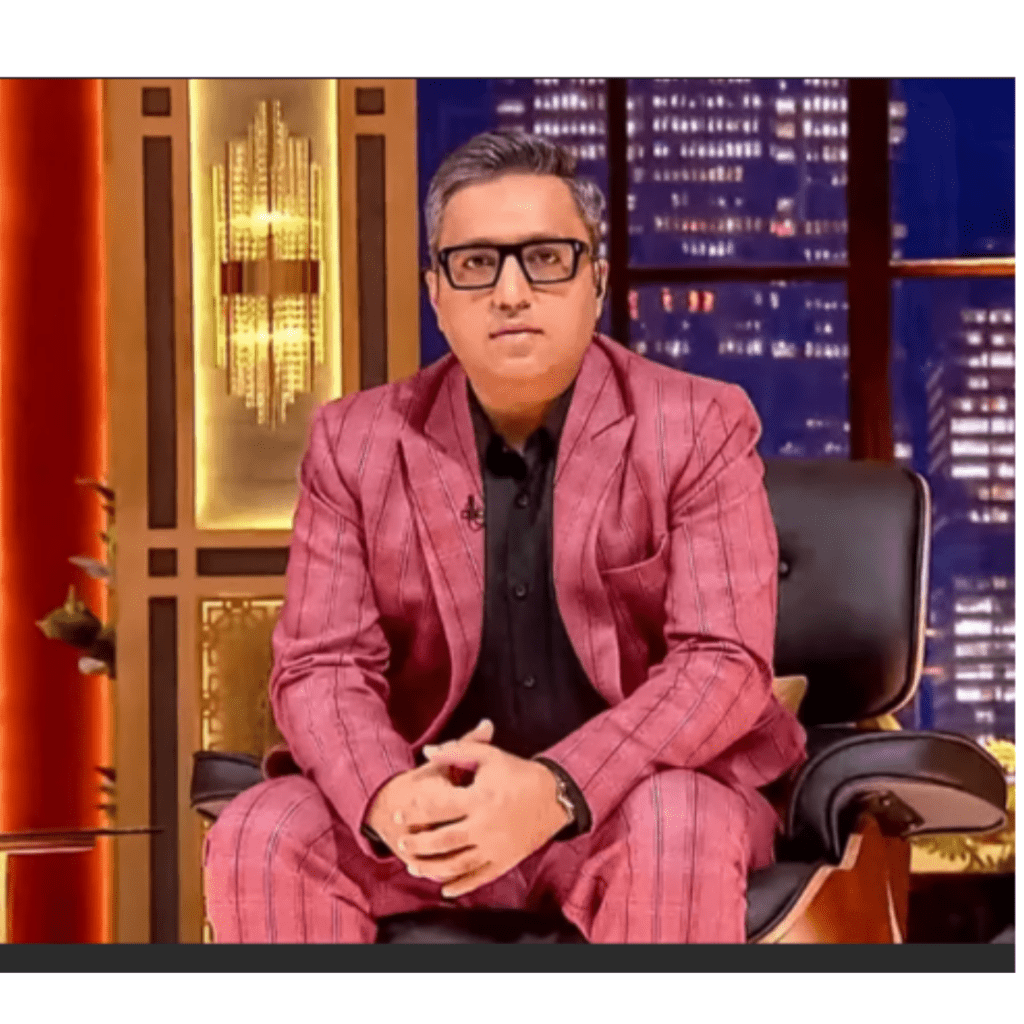

Ashneer Grover’s New Venture, ZeroPe, is set to Transform Healthcare Payments

Ashneer Grover, who became a household name in the first season of Shark Tank with his truth bombs and facts, is all set to launch ZeroPe. The launch of a new fintech platform under Third Unicorn—the parent company of BharatPe, a well-known merchant payments gateway—has been announced recently.

Thank you for reading this post, don't forget to subscribe!

Introduction of ZeroPe: A Fintech Solution for Medical Expenses

The new app will be available on the Google Play Store and has been introduced by Third Unicorn as a fintech solution that targets healthcare payments. Developed to ease the financial burden of medical expenses, the new app offers loans designed to help individuals manage the costs associated with healthcare. The application provides instant pre-approved medical loans up to Rs 5 lakhs, in partnership with Delhi-based Non-Banking Financial Company (NBFC), Mukut Finvest. However, it is important to note that these services are exclusively available at partnered hospitals, as indicated on the ZeroPe app website.

Ashneer Grover’s Strategic Move into Healthcare Financing

The strategic decision by the former Shark Ashneer Grover to venture into medical financing is in line with an emerging trend within the fintech sector. Several competitors, including SaveIn, Qube Health, Arogya Finance, Neodocs, Fibe, Kenko, and Mykare Health, have already established themselves in this niche by offering instant financing solutions for medical bills and elective treatments. This move is a testament to the growing intersection of healthcare needs and financial technology innovations.

Third Unicorn’s Evolution: From Fantasy Sports to Healthcare Financing

Third Unicorn was established in January 2023 by Ashneer Grover and Chandigarh-based businessman Aseem Ghavri. It gained notoriety initially with the release of the fantasy gaming platform CrickPe. This first effort was meant to rival well-known players like Dream11, the Mobile Premier League (MPL), and My11Circle from Games24x7.

The Rise of Digital-First Startups in Healthcare Financing

In this age of digital-first startups, it has been observed in the healthcare financing sector that each aims to offer data-driven medical loans for various healthcare needs. These include hospitalisation, home care, and chronic care management. These startups are increasingly seeking to integrate hospital networks, health insurance providers, and government healthcare schemes to deliver comprehensive financing solutions that meet the growing demands of patients and healthcare providers alike.

Future Outlook: The Growth Trajectory of Digital Healthcare in India

In summary, the introduction of this app by Third Unicorn under the guidance of Ashneer Grover marks a crucial step forward in the convergence of fintech and healthcare services. This initiative not only highlights the transformative potential of digital solutions in addressing critical healthcare financing needs but also sets a precedent for future innovations in the digital healthcare market.

FAQ

Q1: What is ZeroPe?

Third Unicorn has introduced, a new fintech application that offers instant pre-approval medical loans up to Rs 5 lakhs, in collaboration with Mukut Finvest, to provide healthcare payment services.

Q2: Where can I use its services?

Its services are available exclusively at partnered hospitals, allowing users to easily manage medical expenses through the app.

Q3: How does ZeroPe compare to other medical financing services?

Unlike many other services, this app offers seamless integration with hospitals and instant loan approvals, focusing on simplifying the payment process for healthcare needs.

Q4: Who founded ZeroPe?

It was introduced by a company founded by Ashneer Grover, his wife, Madhuri Jain Grover, and entrepreneur Aseem Ghavri.